Quarterly Agricultural Update | Q3 2024

Fri 11 Oct 2024

Brown&Co’s market update provides an overview of commodity prices for 2024. It also provides an overview of points to consider going forward into Autumn 2024, which include Environmental Schemes, Basic Payment Scheme/De-linking, and New Agricultural Policies. Tom Holliday Agricultural Business Consultant

Agricultural Update Summary

The Brown&Co Agricultural Update Report reviews the previous financial quarters, highlighting the changes in market prices and trade patterns of commodities during the period.

This report analyses the cereals, oilseeds, milk, and meat prices, as well as input prices such as fuel, fertiliser, and feed.

- Pork prices decreased slightly this quarter, averaging 209.6 pence per kilo deadweight for the Standard Pig Price (SPP). However, this was only a 1.2 pence per kilo reduction compared to the previous quarter.

- Defra farmgate milk prices have consistently increased during the last three months and peaked at 41.06 pence per litre in August.

- Lamb prices have significantly dropped throughout the quarter from 748.5 pence per kilo deadweight to 641.8 pence per kilo deadweight (R3L). However, the price is still 12.5% higher compared with August 2023.

- The ‘All Steers’ beef prices have seen a consistent increase across the quarter reaching a high of 506.4 pence per kilo deadweight at the end of September.

- Cereal & Oilseed prices have been under pressure going into the third quarter of 2024. Feed wheat prices had a high of £178.9/t at the beginning July and a low of £173.8/t at the end of August.

- Fertiliser prices increased in July, however, settled down to similar prices by the end of September.

- Crude Oil and Red Diesel price have both decreased across the quarter. Oil prices have averaged $75.2/barrel, and red diesel has averaged 68.3 pence per litre across the quarter.

Environmental Schemes

- The Sustainable Farming Incentive (SFI) has started to reopen with a controlled rollout for the new ‘Expanded Offer’.

- The SFI Expanded Offer is experiencing some operational issues with integrating the 102 new actions into the current RPA system.

- Countryside Stewardship capital grants remain open for applications. Funding is available for items such as fencing, hedge laying and other yard works such as concrete.

Pre-budget Announcements

The upcoming Budget announcement on October 30th at 12:30pm is expected to feature several potential key changes:

- Increase in the windfall tax on UK oil and gas profits from 35% to 38%, effective November 1st and lasting until March 31st, 2030.

- The state pension is projected to increase by 4% in April 2025

- VAT is set to be applied to private school fees starting January 1st, 2025, along with the removal of business rates relief for certain schools.

- The National Farmers Union's call for a £2bn increase in the agricultural budget, the future size of the budget is still unclear especially as there has been a £131 million underspend by Defra for 2023/24. However, the Government has pledged to restore trust and stability with a new deal for farmers.

New Agricultural Policy

- The third round of the Defra Future Farming Resilience Fund service is still available, providing business, environmental, planning and development advice to farmers across England which is funded by Defra. Brown&Co continue to be a provider of the service up to 2025, register your interest for the Defra Future Farming Resilience Fund

UK Weather

The beginning of July mirrored June's trend of unseasonably cool weather and increased rainfall, with many regions receiving over 100% of their typical monthly precipitation by mid-month. The temperatures at the start of the month were low, marking it as the coldest start to July since 2004. However, temperatures rose in the third week, leading to some areas experiencing their highest temperatures of the year, and this warming trend continued, resulting in above-average temperatures through the month’s end.

August experienced notable regional variations in temperature and rainfall, starting with widespread thunderstorms that caused flooding in certain areas. The month peaked with a record high temperature of 34.8°C, while prevailing winds from the southwest or west reached speeds of 74 mph. Concluding the month, storm Lilian brought heavy rainfall and strong wind gusts, significantly affecting weather patterns across the region.

September was a largely unsettled month for the UK with persistent showers and variable temperatures throughout the month. The temperatures for September were provisionally -0.3°C below average with a mean temperature of 12.7°C. There was a strong variation between regions for rainfall in September. Southern England provisionally recorded 233% of their average rainfall, which is the wettest September since 1918. Scotland however only recorded 63% of its provisional average rainfall in September.

Harvest 2024 Summary

With harvest now in its closing stages, the story across most of the UK is a picture of below average yields – but not as bad as anticipated back in spring 2024. Rainfall at the time of writing has slowed progress once more and there is concern for quality for the later harvested crops. Ergot has been a significant issue in this year’s harvest and there has generally been a high level of volunteers and grass weeds within this year’s cereal crops.

Average yields for winter barley, oilseed rape, oats, wheat, and spring barley have all decreased, with winter barley seeing a 13% decline at 6.13t/ha, oilseed rape down 7% at 2.97t/ha, oats down 3% at 5.28t/ha, winter wheat down 7.3% at around 7.5t/ha, and spring barley down 3.4% at 5.68t/ha. The impact of weather patterns has led to significant inconsistencies in yields from farm to farm across the country.

Supply Chain

The results for the Northern Hemisphere harvest are now sharpening up the previous forecasts from earlier in the season. The latest figures from the International Grains Council (IGC) show that the previous estimates for wheat and maize production will not change substantially as a whole. However, generally the US, South American and Australian crops are being revised upwards following on from more successful than anticipated harvests. The total estimates for global grain production are now at 2,315 million tonnes, which is the largest crop the world has ever produced. Despite the bumper global crop, stock levels are still anticipated to fall as consumption continues to rise based on current rates.

On September 9, 2024, the UK, USA, and Australia formalised a collaboration through a Memorandum of Understanding (MoU). The MoU is aimed at strengthening cooperation by collectively monitoring and actioning risks relating to the critical supply chains. This cooperation will be undertaken via data sharing and joint action in order to increase reliance for the highest priority supply chains.

Consumer Behaviour

The GfK UK Consumer confidence tracker showed a sharp reduction in confidence for consumers in September. Confidence has reduced to -20 which, is the lowest level for the last 6 months. The confidence reduction is largely due to the anticipation of the potential changes looming in the upcoming Autumn Budget.

The latest results also showed a notable decrease in expectations for personal finances for the next 12 months, with a 9-point drop to -3.

Unsurprisingly, many consumers are still opting for frugal spending habits, such as purchasing cheaper brands or store-owned products, seeking discounts, and utilising loyalty schemes to benefit from savings.

Livestock Markets

Pork

The Standard UK Pig Price (SPP) has had a gradual decrease across the quarter with a finishing price of 209 pence per kilo deadweight (p/kg/dw) at the end of the quarter. The large price differential between UK and EU pork has continued to present downward pressure on the Standard UK Pig Price. In addition to this, domestic retail demand has fallen with primary pork volumes decreasing by 3.8% year on year. This is largely due to the wet UK weather reducing the demand for BBQ products.

Dairy

The farm gate milk price increased to 41.06 pence per litre (ppl) in August, which is the highest price since March 2023. The latest forecasts for GB milk production are to reach 12.28 bn litres for the 2024/25 season, which is 0.3% less than the previous year. Whilst there is a more positive outlook with the increasing milk price, there is still widespread concern over this season’s poor silage quality and the continued labour challenges.

Lamb

- Lamb prices have come under pressure into the third quarter of 2024. Prices started strong at 748.5 pence per kilo deadweight (R3L) however across the quarter they have gradually declined to 641.8 pence per kilo deadweight at the end of the period.

- However, prices have averaged at 664 pence per kilo deadweight (R3L) in the third quarter, which is still 81.2 pence per kilo higher compared to the same period in 2023.

- Estimated sheep kill numbers for the last week of September were down to just under 20,000 head compared to the same week in 2023. The weather pressures for this season have meant lambs have been much slower to come forward, which has knocked production so far.

Beef

- The average deadweight price for prime cattle continues to increase to record highs. The ‘All Steers’ deadweight price hit 506 p/kg/dw in the last week of September, which prompted further estimated kill increases of 1,700 head to 34,400 head for prime cattle.

- The price increase can be largely attributed to the festive season procurement period beginning, which adds price pressures at this time of year. There are also expectations of a tighter cattle supply going into the final quarter of 2024.

Feed

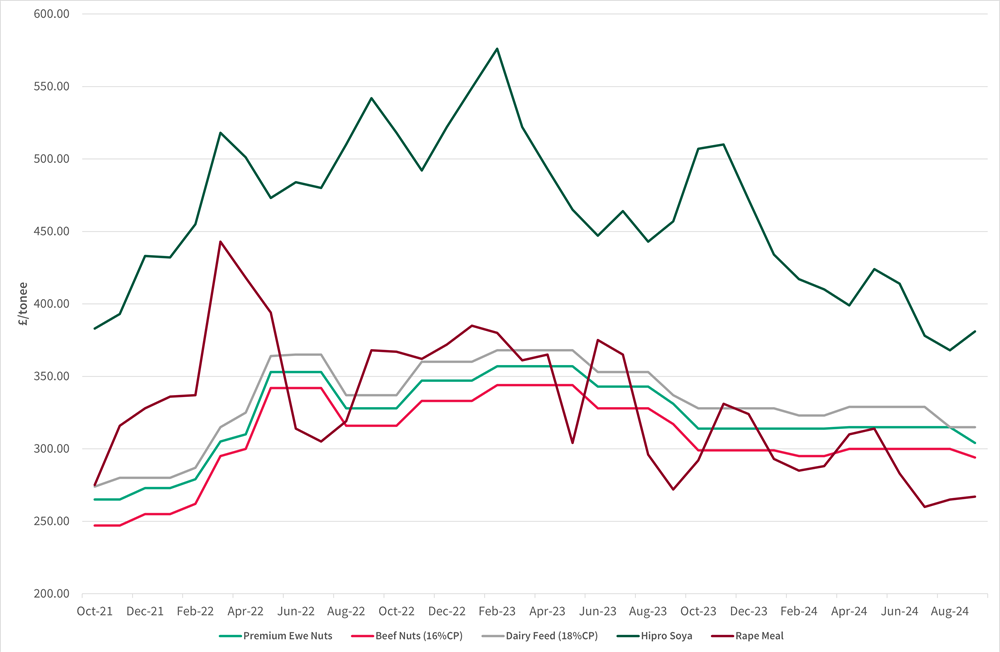

- Feed prices for dairy feed, premium ewe nuts, and beef nuts remained relatively stable at the start of the quarter with an average £10/tonne drop in price at the end of the quarter.

- Hipro soya and rape meal experienced the opposite trend, with a sharp drop in price at the start of the quarter, but then an average £6/tonne increase in price across the two commodities at the end of the quarter.

Meat Trade

Beef Meat Trade

- UK imports from the EU have remained relatively settled.

- UK exports to the EU remained at approximately 9,500 tonnes for May and June, with a drop to 8,300 tonnes in July.

- The UK is still a significant net importer of beef, with a net balance of 10,780 tonnes in July.

Wheat, Barley & OSR Price Trends

Sheep Meat Trade

- UK exports to the EU fell significantly between April and July compared to the start of the year. A tightening of the UK sheep meat supply has resulted in increased imports.

- The UK imports from non-EU peaked in July at 7,110 tonnes. Combined with the reduction in UK exports to the EU, the UK became a net importer of sheep meat for the first time since August 2022.

- Feed wheat prices remained under pressure within this quarter and averaged £175/tonne.

- Milling wheat premiums experienced a significant drop down to £52/tonne in September to the lowest levels since March 2023.

- Barley prices dropped at the beginning of the quarter to a low of £141/tonne. There was some price recovery towards the end of the quarter finishing at £156/tonne.

- Oilseed rape has experienced a degree of price recovery in the third quarter of 2024. There was a £20/tonne price increase throughout the quarter and prices finished at £381/tonne at the end of September.

- Crude Oil and Red Diesel prices significantly decreased from mid-August, with the sharpest drop occurring in mid-September. Red diesel hit a low of 50.9p/litre on the 13th

- Global oil demand continues to decelerate and is at the lowest level since 2020. The demand slump is predominately driven by the continual slowdown in the Chinese economy.

- Fertiliser prices have stabilised since June 2023; however, the recent August rally in gas price has sharpened focus on forward pricing.

- The recent escalation of the conflict in the middle east has increased global gas supply concerns. However, robust storage within the UK and Europe has somewhat eased concerns in the medium term. The ongoing geopolitical tension is expected to add an additional volatility factor to pricing depending on the further intensification of conflict.

For for further details please contact the Agricultural Business Consultancy Team at your local Brown&Co office

Keep updated

Keep up-to-date with our latest news and updates. Sign up below and we'll add you to our mailing list.

Brown&Co

Brown&Co