Quarterly Agricultural Update | Q1- Q2 2024

Fri 02 Aug 2024

Brown&Co’s market update provides an overview of commodity prices for 2024. It also provides an overview of points to consider going forward into Summer 2024, which include Environmental Schemes, Basic Payment Scheme / De-linking, and New Agricultural Policies. Tom Holliday, Agricultural Business Consultant

Summary

Our Agricultural Update Report reviews the previous financial quarters, highlighting the changes in market prices and trade patterns of commodities during the period.

This report analyses the cereals, oilseeds, milk, and meat prices, as well as input prices such as fuel, fertiliser, and feed.

- Pork prices decreased slightly into 2024 with the first two quarters averaging at 211 pence per kilo deadweight for Standard Pig Price (SPP).

- Defra farmgate milk prices have remained relatively stable during 2024 with an average price of 38.03 pence per litre.

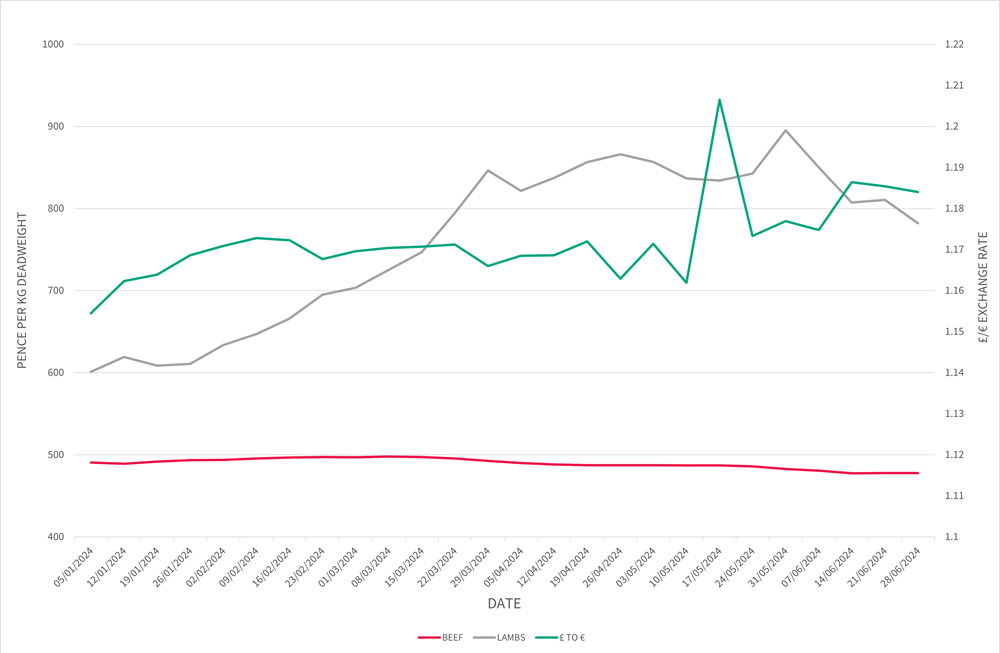

- Lamb prices have experienced a significant price rally into 2024 hitting a peak of 895.1 pence per kilo deadweight (R3L) on the 31st May 2024.

- Beef prices started off strong at 490.5 pence per kilo deadweight in the first week of January 2024. The prices however, then started to decrease into the second quarter hitting a low of 477.4 pence per kilo deadweight in June.

- Cereal & Oilseed prices were under pressure going into the first quarter of 2024, hitting a low of £158/t in March for feed wheat. Prices showed an increase into the second quarter where feed wheat peaked at £194.9/t. Following the peak, the prices came under pressure towards the end of June.

- Fertiliser prices have remained predominantly settled in 2024 with a slight price increase in June.

- Crude Oil and Red Diesel prices significantly decreased leading into the start of 2024 but then started to increase

into the first quarter of 2024. Oil prices have averaged $78/ barrel so far in 2024, and red diesel has averaged 76.5 pence per litre.

Points to consider for 2024

Environmental Schemes

The Sustainable Farming Incentive has started to reopen with a controlled rollout for the new ‘Expanded Offer.’

The new actions will include items such as spring or summer cover

crops, no tillage farming and precision farming.

Countryside Stewardship capital grants remain open for applications. Funding is available for items such as fencing, hedge

laying and other yard works such as concrete.

Basic Payment Scheme

Cross compliance officially ended on the 31st December 2023. However, farming and land

management regulations still apply.

Despite cross compliance ending, new hedgerow regulations approved in May require a 2-metre buffer strip to be reestablished next to a hedgerow where no cultivation or application of pesticides or fertilisers are allowed on this buffer strip.

A hedgerow cutting and trimming ban from 1st March to 31st August (inclusive) is also included in the new regulations.

New Agricultural Policy

The BPS lump sum exit scheme has now closed for applications. Farmers had until the

31st of May 2024 to provide evidence that they have transferred out their agricultural land.

The third round of the Defra Future Farming Resilience Fund service is now available, providing business, environmental, planning and development advice to farmers across England and is funded by Defra.

Brown&Co continue to be a provider of the service up to 2025, register your interest here: Future Farming Resilience Fund

UK Weather

The start of January was mild but wet continuing the theme of December.

In the first week, most of central and the south of England had already received around two thirds of thewhole months’ average rainfall. However, after this a high-pressure system arrived across the UK bringing dry, sunny

conditions but a drop in temperature. Around the middle of the month a northerly flow of cool air brought snow showers across much of the north. On January 28th, a new daily maximum temperature of 19.9°C was recorded

in Sutherland.

February started off mild but wet continuing with the unsettled theme since Autumn 2023. Snow hit northern England, Scotland and Northern Ireland on the 7th and 8th creating disruption among many areas. However, the south of England experienced mild temperatures throughout this cold spell,

leading to a temperature rise across the UK. The UK overall was 2.2°C warmer than average making it the second warmest February since records began. Many parts of the UK also received two to three times the amount of average rainfall.

March was predominately another wet and dull month. It started colder than average across the UK, with snow falling early in the month across parts of southwest England, causing some travel disruption. However, the cool weather

was replaced with mild weather for the rest of the month, with temperatures averaging 6.7°C which is 1.0°C above the average. The UK recorded 127% of the long-term average rainfall for March and only 87% of the long-term

average for sunshine.

Thunderstorms started off the month of May across much of southern England. A highpressure system covered much of England and Wales from the 8th, the clear conditions coincided with the aurora borealis making the solar flare visible across most of the UK. May was another record-breaking month with the highest recorded mean temperature of 13.1°C, and the 22nd of the month provisionally recording the wettest spring day on record for northern England. Keswick received 94.8mm of rain on the 22nd which was double the previous

highest record.

June started off cool across the UK with winds bringing Arctic air from the north. June defied the reoccurring wet monthly trend, with only a recorded 71% of the average rainfall in June. Later into the month, high pressure brought warmer temperatures bringing a mini heatwave with temperatures reaching as high as 30°C on the 26th. However, the hot spell was only brief,

and temperatures returned to below average for the last few days of June.

Harvest 2024 Outlook

The results are in for the AHDB’s planting and variety survey and whilst the outlook does look better than the initial results from the AHDB Early Bird Survey (EBS), the outlook is showing the lowest cereals and OSR area in Great Britain for over two decades.

Broadly speaking, crop conditions have started to improve since May with many crops being on track for a timely harvest. However, as expected, many winter crops are in poor condition given the relentless weather challenges for this growing season. 14% of Great Britain winter wheat has been rated as very poor or poor, 11% of winter barley has been rated very poor or poor and 21% of OSR has been rated very poor to poor.

Spring crops have fared well generally and appear strong. However,

the late drilling for many areas has left it unclear on the full yield potential.

The UK wheat area is estimated to achieve 1,560 Kha in 2024 which is a 9% drop compared to the previous year.

Climate & Carbon

The latest data has shown the strong El Niño event has continued to lift Global temperatures.

Every month from June 2023 to April 2024 have set all time monthly highs for 10 months in a row. The average global

temperature for 2024 so far is higher than any previous annual record. However, the fading El Niño conditions which should develop into a La Niña event later in the year which is anticipated to alter global temperatures.

The UK achieved close to a record share of 50.9% of total energy generation from renewables in the first quarter of 2024, second only to the final quarter of 2023. It was also the second consecutive quarter where wind contributed more electricity than gas generation.

The last large surface coal mine Ffos-y-Fran closed at the end of November 2023 meaning output from coal in the UK is at a record low of 20k tonnes in the first quarter of 2024.

Supply Chain

At the time of writing global grain production has been forecast higher with increases for United States, Pakistan, Canada, and Argentina for 2024/25.

Global grain stocks have been raised; however, they are still at the lowest level since 2015/2016.

Expectations of a tightening exportable supply from Russia and Ukraine, and speculation about increased demand from India are pushing the global wheat export quotes higher.

Consumer Behaviour

According to the Deloitte Consumer Tracker, the UK consumer confidence has increased for the 6th consecutive quarter and has reached its highest level in 2.5 years.

The combination of falling inflation and real terms wage growth overtaking inflation levels has led to consumer sentiment towards their personal finances continuing to improve. However, consumers were more negative about their job security and career progression in the first quarter of 2024. This bucked the trend of the previous four quarters where it continued to improve.

The prospect of lower interest rates has played a role in supporting

consumers to buy bigger ticket items. The outlook for the rest of

2024 is showing signs of recovery after a challenging few years for

consumers.

Pork

The Standard UK Pig Price (SPP) has come under pressure for the first two quarters of 2024 finishing at a price of 210 pence per kilo deadweight (p/kg/dw) at the end of this quarter.

A decline in exports to China and Japan have put pressure on export markets, however growth in other Asian countries such as South Korea, the Philippines and Vietnam had counteracted these declines to some extent.

Dairy

The farm gate milk price had a sharp increase in April of 0.98

pence per litre (ppl) to 38.41 ppl. This then decreased down to 37.92 ppl in May.

Overall, the milk deliveries in Great Britain have decreased in supply volume due to the poor weather from Autumn 2023 through to Spring

2024. Grass availability improved in June bringing production levels to only 0.2% lower compared to the same point a year ago.

Grass growth had a poor start to the season but largely recovered in time for most producers to recover a reasonable first cut of silage. Despite

respectable first cut yields, there has been variable quality between regions. It is still unknown how successful the second cut for silage will be for UK producers but there is a larger decline in milk production expected for the 2024/25 season.

Beef

Beef prices started strong into 2024

and the “all steers” deadweight price peaked at 497.9 p/kg at the start of March.

Prices have come under pressure into the second quarter of 2024 and finished the quarter at 477.8 p/ kg for “all steers”.

Beef production in the EU has seen a 4% increase in the first three months of 2024 compared to the performance in 2023. The largest increases have

come from Italy and Poland.

As the weather has finally started to improve (mostly), it is anticipated the sun and summer sports events will support demand for barbeques and increase uptake for beef steak and burger items.

Lamb

Lamb prices have had an incredibly strong start to the year and peaked at 985.1 pence per kilo deadweight (R3L).

Prices have averaged at 761 pence per kilo deadweight (R3L) for the first two quarters of 2024 which is 167 pence per kilo higher compared to the same period in 2023.

Sheep meat production in the EU remained at 95,000 tonnes for the first 3 months of 2024 which is a drop of 4% compared to the same period

in 2023. The main decline stems from the top producers Spain and Greece having significant drops in production predominately due to droughts.

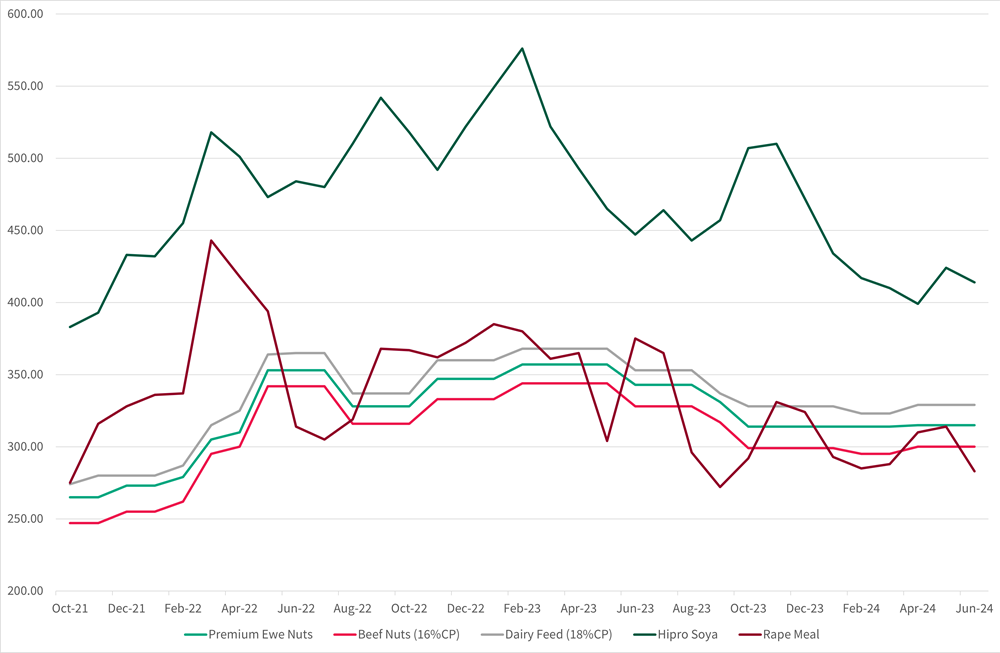

Feed

Feed prices for dairy feed, premium ewe nuts, and beef nuts have remained stable for the first two quarters of 2024.

Hipro soya and rape meal decreased consistently in the first quarter of 2024. They both spiked in price into the second quarter but then decreased again in June.

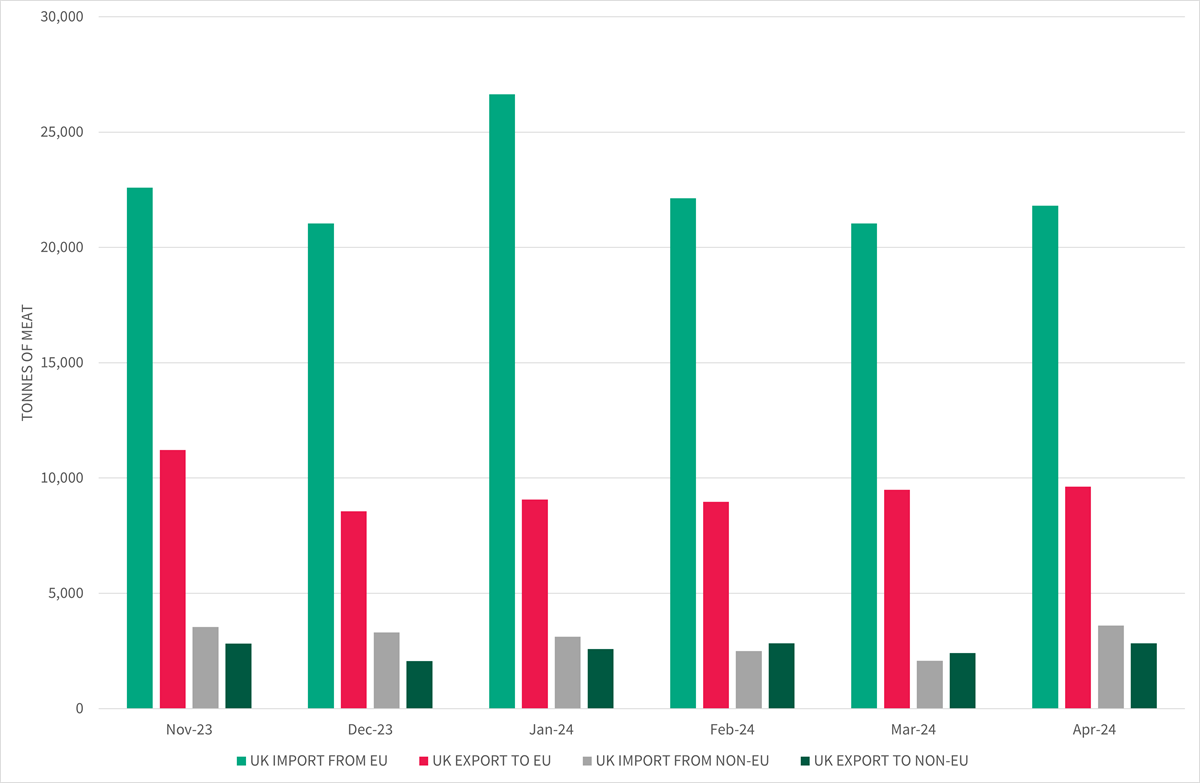

Beef & Sheep Meat Trade

Beef

- UK imports from the EU peaked in January 2024 at 26,637 tonnes.

- UK exports to the EU peaked in November 2023 11,216 tonnes

- The average trade levels between January and April 2024 equate to a net import of 55,089 tonnes for the UK.

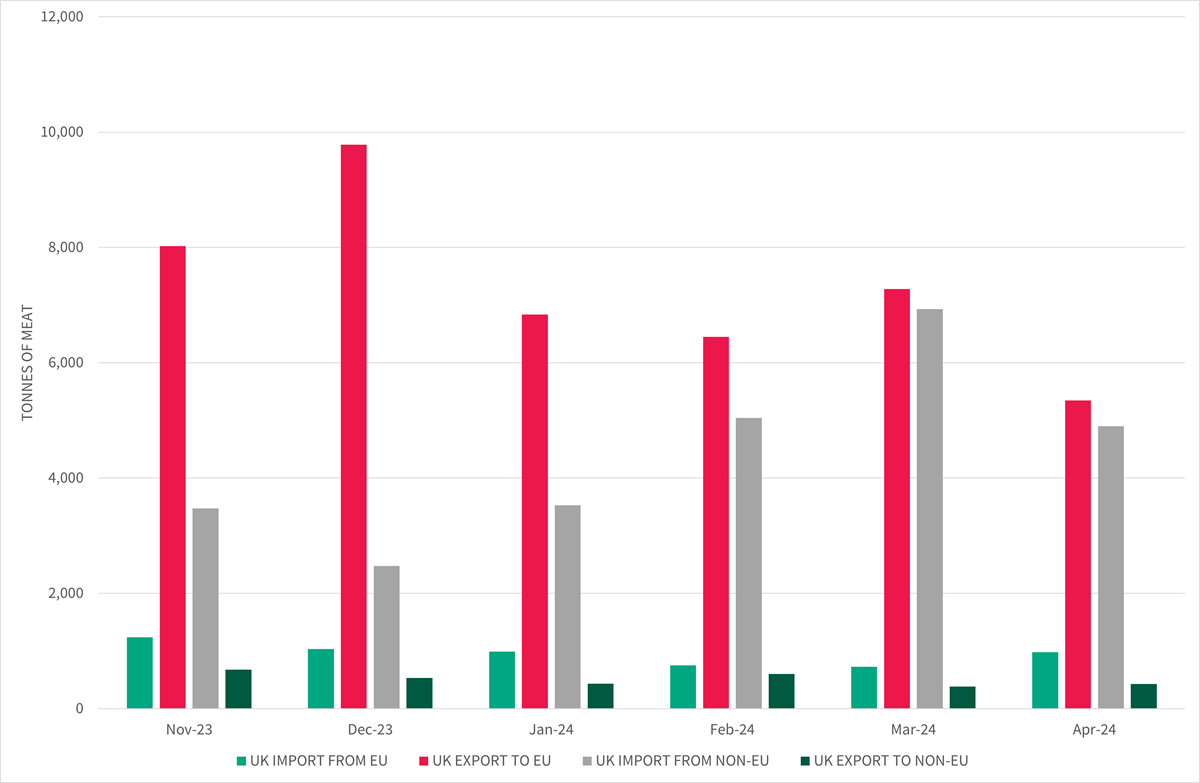

Lamb

- UK exports to the EU peaked in December at 9,781 tonnes, which was the highest level since before the pandemic.

- The UK imports from non-EU locations peaked in March 2024 at 6,929 tonnes in line with religious holidays.

- The average trade levels between January and April 2024 equate to a net export of 3,908 tonnes from the UK.

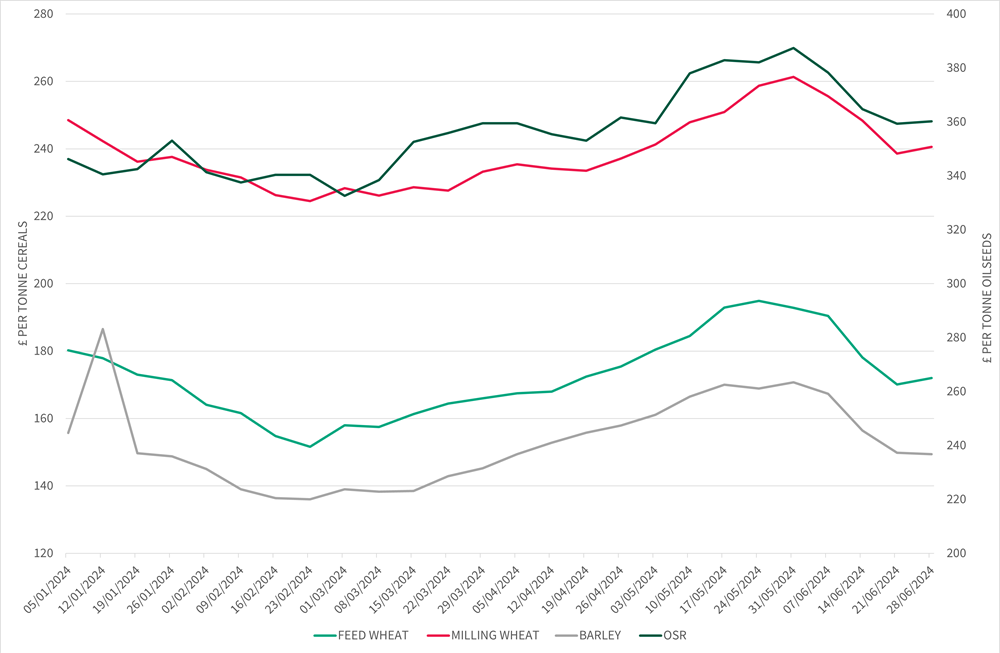

Wheat, Barley and OSR Price Trends

Feed wheat prices increased towards the end of the second quarter in 2024, hitting a peak of £195/t at the end of May. However, prices have consistently come under pressure since June.

Milling wheat prices followed a similar trend to feed hitting a high of £261/t at the end of May before dropping. The milling premium over feed was at its highest level towards the end of February at £73/t.

Barley prices came under heavy pressure at the start of 2024 with a consistent drop in price throughout February hitting a low of £136/t at the end of the month. This was the lowest price since October 2020.

Oilseed rape has remained a big question mark within the rotation for many UK growers and the prices in 2024 certainly have not helped the case. Oilseed rape prices hit a low of £332/t at the start of March but did show some recovery into the second quarter hitting a high of £387/t.

At the time of writing, better than anticipated harvest yields for the US, Brazil and Russia have spiked supply expectations which has added to a further retreat in grain prices.

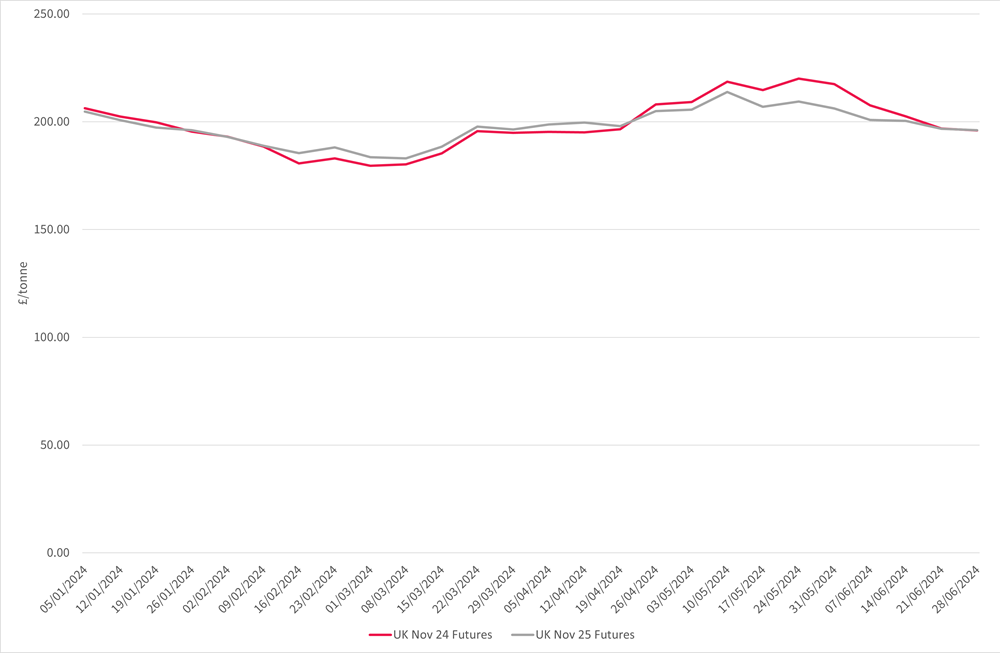

Futures Market

The Nov 2024 and 2025 wheat futures have remained close to the £200/t level during the first two quarters of 2024, however, they did experience a swing of £20/t either side of this level.

The Nov 2024 wheat futures price peaked at £220/t on the 24th May 2024.

The Nov 2025 wheat futures price peaked at £214/t on the 10th May 2024.

The Nov 2024 wheat futures price hit a low of £179/t on the 1st March 2024.

The Nov 2025 wheat futures price hit a low of £183/t on the 8th March 2024.

Inputs

Oil prices increased in June despite global demand easing slightly and growing concerns over the Chinese economy. The post pandemic rebound within China is now starting to turn.

The global oil demand growth decelerated to only 710 thousand barrels per day (kb/d) in the second quarter of 2024 which is the lowest quarterly increase in over 12 months.

Global oil supply has had an upward trend into the second quarter of 2024 with production increasing to 910 kb/d from the first quarter. Production is predicted to increase by a further 770 kd/d into the third quarter of 2024 with non-OPEC+ producing nations providing the majority of this gain.

Fertiliser prices have stabilised since June 2023; however, they still remain higher than pre pandemic levels.

Whilst natural gas prices have decreased significantly from the peaks experience in 2022, the prices still remain much higher compared to pre pandemic levels. Because of this, the European fertiliser producers are experiencing difficulties returning to “normal” levels due to the price pressures of fertiliser and gas.

For more information, please contact your local Brown&Co office by clicking on the button below.

Keep updated

Keep up-to-date with our latest news and updates. Sign up below and we'll add you to our mailing list.

Brown&Co

Brown&Co